7% External Loan in Italian Lira

Repubblica di Polonia Prestito Estero 7% in lire italiane (Prestito Polacco 7%)

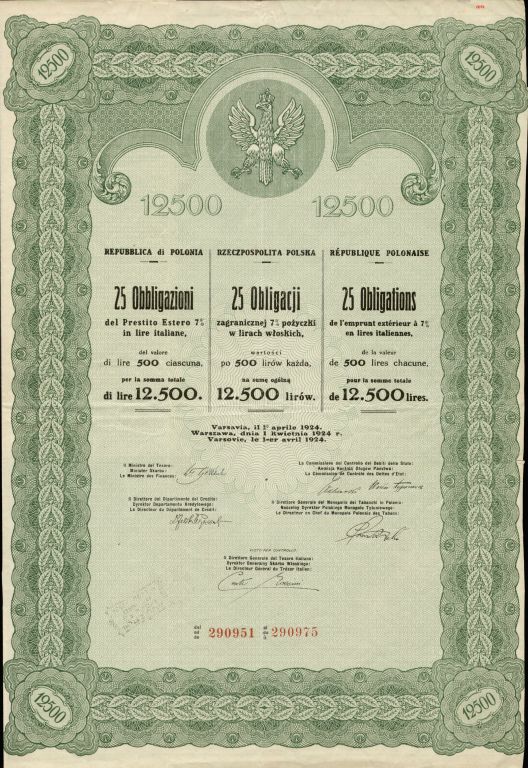

Bonds issued on 1 April 1924 (246×353)

9.1 1 bond of 500 lire = 500 lire

9.2 5 bonds of 500 lire = 2500 lire

9.3 25 bonds of 500 lire = 12500 lire

9.4 50 bonds of 500 lire = 25000 lire

This issue is known as „Tobacco Loan” because of the collateral provided and the fact that an obligation to purchase large quantities of Italian grown tobacco was part of the deal. It was the first commercial foreign currency loan granted to newly independent Poland. In Italian literature it is known as “Prestito Polacco 7%”.

Legal basis:

- Ordinance of the President of the Republic of Poland of 13 March 1924 on issuance of external 7% bonds in Italian lire (Dz.U. RP 24.25.257).

- Decision of the President of the Republic of Poland of 12 April 1924 supplementing ordinance of 13 march 1924 on issuance of external 7% bonds in Italian lire (Dz.U. 1924.33.338).

- Ordinance of the Minister of the Treasury of 2 May 1924 on securing funds for payment of interest on and amortization of external 7% bonds in Italian lire and on creation of a reserve fund (Dz.U. 1924.41.438)

Information about the issue:

This issue is known as “Tobacco Loan” because it was secured on revenues of the State Tobacco Monopoly which was also obliged to purchase large quantities of Italian grown tobacco (not of the premium sort by the way).

Bonds with the nominal value of 400 million lire were circulated in two tranches: In April 1924 bonds with nominal value of 300 million were issued at 460 lire per 500 lire bond and the reminder of 100 million lire was issued in October 1924 at 473 lire per 500 lire bond.

Repayment of this loan was very well secured by all revenues and immovable property of State Tobacco Monopoly which generated an income of 130 million zloty in 1924 and over 420 million zloty in 1930 while the amount necessary to service the whole loan did not exceed 23 million zloty per year. So the collateral was grossly excessive.

During first 10 years of the loan term Poland was obliged to contribute to so-called reserve fund administered in the name of Italian government by Banca Commerciale Italiana. Funds were invested in Italian government treasury bills and bonds. Contributions were fixed at 16 million Italian lire per year (4% of the initial amount of the loan) during first 5 years and at 12 million Italian lire (3% of the initial amount of the loan) thereafter. Contributions were payable in half-yearly installments.

At the end of June 1933 this fund was worth 175.965.700 lire (contributions plus income from interest). At that time on the basis of special Treaty of 30 October 1933 further contributions have been suspended for the period of 2 years and it has been agreed that interest on the loan and amortization installments due until the end of 1934 would be paid out of reserve fund assets.

Real cost of this loan reached 11,6% because bonds were issued at a discount, extra contributions towards amortization fund were required and all Italian taxes and stamp duties were paid by the issuer i.e. by Poland.

This was the only external loan serviced without any interruptions even after currency control measures and transfer restrictions implemented in April 1936 by Poland. Bonds were being serviced and retired on time according to the original repayment schedule:

1 January 1931 – outstanding nominal amount of 330.233.000 lire

1 October 1936 – outstanding nominal amount of 246.000.000 lire

1 April 1939 – outstanding nominal amount of 179.996.500 lire and this amount remained in circulation at the outbreak of the II World War.

The loan was guaranteed by the Italian State should Poland be unable to service bonds due to an armed invasion of its territory. Special protocol granted also the right to put up Italian flags on State Tobacco Monopoly buildings and this actually happened after German invasion. This guarantee was honored in 1940 a special decree provided an option to exchange outstanding bonds into 5% Italian treasury bills (majority of which came from assets of reserve fund mentioned earlier). It appears that in 1940 the amount of bonds still circulating exceeded reserve fund assets by only 40 million lire, but in practice Italian Treasury had to fork out less as not all bonds were presented for exchange. The fact is that vast majority of all bonds were retired and probably destroyed so today any remaining specimens are extremely rare.