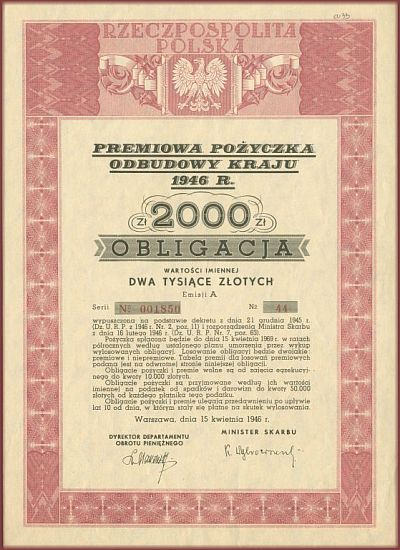

First loan floated by Poland after the war. Issued on 15 April 1946 on the basis of:

- Decree of 21 December 1945 on authorizing Minister of Treasury to float National reconstruction Premium Loan of 1946 (Dz.U. 1946 number 2 item 11)

- Minister of Treasury Ordinance of 16 February 1946 on floating National reconstruction Premium Loan of 1946 (Dz.U. 1946 number 7 item 63).

- Minister of Treasury directive of 1 February 1946 on subscription of National Reconstruction Premium Loan of 1946 (M.P. 1946 number 15 item 24).

Issued in 5 tranches: A, B, C, D i E. Each tranche was divided into series numbering 50 bonds of 2000 zlotys each. Issued at 100% of the face value. No interest was payable but prizes were drawn.

Bonds of 2000 zlotys and ¼ bonds of 500 zlotys were printed. Loan was supposed to be fully amortized by 15 April 1969 in 46 half-yearly installments when certain number of bonds was drawn for redemption either at face value or with premium (4000 to 500.000 including face value of 2000 zlotys bond).

The amount actually floated was not defined up front. Authorities were afraid that if defined target is not met it may have negative impact on the image of newly established communist regime. Subscription was open until 31 May 1946. This deadline had been eventually extended until 20 June 1946 allowing for supplementary subscription on the basis of:

this extraordinary provision allowed payment with so-called depositary receipts issued in lieu of banknotes of Bank Emisyjny w Polsce which were presented in 1945 for exchange over limit set at 500 zlotys per head (see: Currency after 1939) – as it turned out this was the one and only opportunity to cash those receipts.

Technically subscription was voluntary but all strata of the society were pressured to subscribe as much as possible. There were even subscription norms circulated with targets set in line with individual wealth of the subjects. Some government agencies even refused to perform official duties if the applicant did not provide an evidence of sufficient (in the opinion of government official) and paid-up subscription. This was of course illegal but the regime pretended not to notice such conduct.

Owners of bonds were entitled to preferential treatment – potential profits from bonds were tax-free, bonds with value not exceeding 10.000 were exempted from seizures and were accepted in payment of inheritance taxes up to the limit of 50.000 złoty. Additionally owners were authorized to get preferential treatment while participating in government tenders or contracts concluded with State Treasury.

Finally Ordinance of Minister of Treasury of 12 December 1946 on determination of the amount of National Reconstruction Premium Loan, amortization plan thereof and determination of number and amounts of prizes (Dz.U. 1946 number 71 item 393) set the amount of this issue at 4.500.000.000 zlotys: series A, B, C i D @ 1 billion zlotys (10.000 series of 50 bonds of 2000 zlotys) and series E @ 500 million zlotys (5000 series of 50 bonds of 2000 złoty).

According to data published by Ministry of Treasury as of 29 August 1946 the loan was subscribed by 1.905.629 persons for the total amount of 4.662.813.000 złoty (the informal target being 3 billions). Subscription payments amounted to 4.444.000.000 złoty including 240.000.000 in depositary receipts issued in exchange for Bank Emisyjny banknotes.

Bonds printed:

- 2000 zlotys

- 500 zlotys (4 such bonds formed one sheet corresponding with 2000 zlotys bond. All bear same number but different roman numerals I, II, III i IV).

2000 zlotys bond (click to see other items)

2000 zlotys bond (click to see other items)

Fate of those bonds was sealed by 1950 currency reform. On the basis of Decree of 9 February 1953 on conversion of National Reconstruction Premium Loan of 1946 (Dz.U. 1953 number 10 item 31) holders were able to convert their bonds into bonds of National Development Loan of 1951 at the same rate as used for cash exchange i.e. 100:1 (see: Currency after 1939). This decree categorically stated that bonds drawn but not presented for redemption and undrawn bonds not presented for conversion by end of May 1953 will become void from 1 June 1953. End of the story? Well, not really 😛

It appears that in “workers and peasants” paradise nothing was so simple, as quite recently I have found a regulation number 72/67 issued on 12 July 1967 by Minister of Finance regulating various aspects of internal debt service which in paragraph 4 states “Foreign Department of the Ministry of Finance is obliged to secure (in foreign exchange expenditure plan) funds necessary for redemption of 1946 National Reconstruction Premium Bonds presented by Canadian subscribers“. So the loan which on 1 June 1953 had been declared to be legally dead, was still alive and kicking in 1967. Unfortunately I was not able to find any other details on this mysterious “Canadian subscription”. I assume that behind this resurrection there was some sort of compensation agreement signed with Canada.